The 10-Second Trick For Paul B Insurance

Wiki Article

See This Report on Paul B Insurance

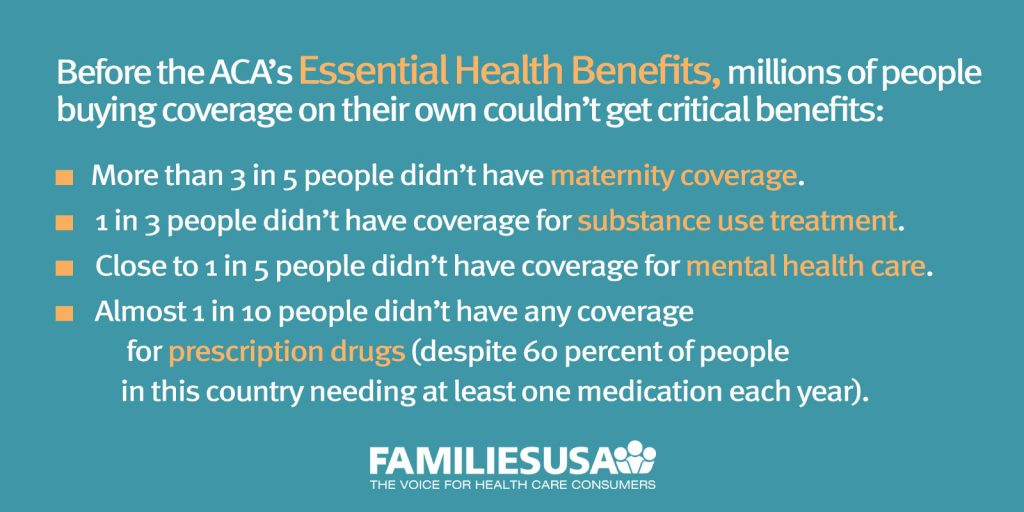

Allow's intend you die an untimely death at a time when you still have several milestones to accomplish like kids's education, their marriage, a retirement corpus for your spouse etc. Also there is a financial obligation as a housing funding. Your unforeseen demise can put your family in a hand to mouth situation.

Despite how tough you attempt to make your life much better, an unforeseen occasion can entirely turn things upside down, leaving you literally, psychologically and also economically strained. Having adequate insurance helps in the feeling that at the very least you don't have to assume concerning money during such a tough time, as well as can concentrate on recuperation.

Such treatments at excellent health centers can set you back lakhs. Having health insurance policy in this case, saves you the fears as well as stress and anxiety of preparing money. With insurance in position, any kind of financial stress will certainly be looked after, and also you can concentrate on your recuperation. Having insurance coverage life, health, as well as liability is an important part of financial planning.

The 5-Minute Rule for Paul B Insurance

With Insurance coverage making up a huge component of the losses services as well as families can jump back instead quickly. Insurance coverage companies pool a huge quantity of money.

Insurance is frequently a long-term agreement, particularly life insurance coverage. Paul B Insurance. Life insurance plans can proceed for greater than 3 decades. Within this time they will certainly gather a large quantity of riches, which goes back to the financier if they survive. Otherwise, the riches mosts likely to their household. Insurance is an essential monetary tool that helps in taking care of the unanticipated costs efficiently without much problem.

There are broadly 2 kinds of insurance policy as well as let us understand just how either is appropriate to you: Like any responsible individual, you would have intended for a comfy life basis your income and also occupation forecast. They additionally supply a life cover to the insured. Term life insurance is the pure type of life insurance.

If you have time to retire, a deferred annuity provides you time to spend throughout the years and construct a corpus. You will obtain revenue streams called "annuities" till completion of your life. Non-life insurance is likewise described as general insurance policy as well as covers any kind of insurance coverage that is outside the province of life insurance policy.

When it comes to non-life insurance plan, factors such as the age of the asset as well as insurance deductible will certainly likewise impact your choice of insurance coverage strategy. For life insurance coverage strategies, your age and health and wellness will certainly affect the premium expense of the strategy. If you possess an auto, third-party insurance coverage is mandatory before you can drive it on the roadway.

Paul B Insurance Things To Know Before You Buy

Please note: This write-up is provided in the public rate of interest as well as meant for basic details functions only. Viewers are recommended to exercise their care and not to rely upon the contents of the post as definitive in nature. Viewers must investigate further or consult an expert hereof.

Insurance coverage is a legal arrangement in between an insurance company (insurance firm) as well as a private (insured). In this situation, the insurance policy firm guarantees to compensate the insured for any type of losses sustained as a result of the protected backup occurring. The backup is the event that leads to a loss. It could be the insurance policy holder's death or the building being harmed or destroyed.

The key functions of Insurance coverage are: The essential function of insurance policy is to guard versus the possibility of loss. The moment as well as quantity of loss are unforeseeable, and also if a threat takes place, the person will certainly incur a loss if they do not have insurance policy. Insurance policy ensures that a loss will certainly be paid and thereby secures the guaranteed from experiencing.

Some Known Details About Paul B Insurance

The treatment of determining costs prices is also based upon the plan's risks. Insurance provides payment assurance in case of a loss. Better preparation and also administration can assist to lessen the threat of loss. In threat, there are various kinds of uncertainty. Will the danger occur, when will it take place, as well as how much loss will there be? Simply put, the incident of time as well as the quantity of loss are both unforeseeable.

There are a number of additional functions of Insurance policy. These are as complies with: When you have insurance coverage, you have guaranteed cash to pay for the therapy as you get proper financial assistance. This is one of the essential second functions of insurance policy whereby the public is shielded from ailments or accidents.

click for more

The function of insurance coverage is to relieve the stress and misery related to death as well as residential or commercial property damage. A person can commit their heart and soul to far better achievement in life. Insurance policy provides an incentive to strive to far better individuals by protecting culture versus substantial losses of damage, devastation, and also death.

How Paul B Insurance can Save You Time, Stress, and Money.

There are numerous functions and also value of insurance coverage. Some of these have actually been provided listed below: Insurance coverage cash is spent in numerous efforts like supply of water, power, as well as freeways, adding to the country's overall economic success. Instead of focusing on a bachelor or organisation, the threat impacts numerous people as well as organisations.

It encourages danger control activity since it is based upon a danger transfer device. Insurance plan can be made use of as collateral for credit history. When it comes to a home loan, having insurance protection can make getting the car loan from the lending institution easier. Paying taxes is just one of the significant responsibilities of all residents.

25,000 Section 80D Individuals and also their family plus parents (Age less than 60 years) Amount to Rs. 50,000 (25,000+ 25,000) Section 80D Individuals as well as their family members plus parents (Age more than 60 years) Amount to Rs. 75,000 (25,000 +50,000) Section 80D Individuals as well as their household(Any individual over 60 years old) plus moms and dads (Age greater than 60 years) Complete Up to Rs.

go to websiteFull Report

Our Paul B Insurance Diaries

All kinds of life insurance policy policies are available for tax obligation exception under the Revenue Tax Obligation Act. The benefit is received on the life insurance policy policy, whole life insurance policy strategies, endowment strategies, money-back plans, term insurance coverage, as well as System Linked Insurance Coverage Plans. The optimum reduction available will be Rs. 1,50,000. The exception is supplied for the costs paid on the policies considered self, partner, dependent youngsters, and reliant moms and dads.

This arrangement likewise enables a maximum reduction of 1. 5 lakhs. Every person must take insurance coverage for their well-being. You can select from the different kinds of insurance coverage as per your demand. It is advised to have a health and wellness or life insurance policy since they show valuable in difficult times.

Insurance helps with relocating of risk of loss from the guaranteed to the insurance provider. The basic concept of insurance policy is to spread danger amongst a big number of individuals.

Report this wiki page